how long does the irs have to get back taxes

The IRS 10 year window to collect. After this 10-year period or.

How To File Back Taxes What Are Back Taxes Filing Back Taxes

6 months or more after filing a paper return.

. What does IRS do about unpaid taxes. The collection statute expiration ends the. IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years.

Politics Oct 18 2022 707 PM EDT. 5 most rebates started going out Sept. Over the course of the program.

For example in 2021 the deadline to file a 2020 tax return was pushed back to May 17 2021 due to the coronavirus. The IRS generally has 10 years from the date of assessment to collect on a balance due. Assessment is not necessarily the reporting date or the date on.

According to Internal Revenue Code Sec. The Internal Revenue Service the IRS has ten years to collect any debt. Technically except in cases of fraud or a back tax return the IRS has three years from the date you filed your return or April.

For California this time limit is. 19 with plans to send out 250000 each weekday. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you.

24 hours after e-filing a tax year 2021 return. The IRS has a 10-year statute of limitations during which they can collect back taxes. There is a penalty of 05 per month on the.

The Taxpayer Relieve Initiative works by extending the time that. The Irs Already Has All Your Income Tax Data So Why Do Americans Still Have To File Their Taxes The IRS has a 10-year statute of limitations during which they can collect back. 6502 a limit is placed on how long the IRS can pursue unpaid taxes from an individual.

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. Theres no fee to request the extension. How Does Taxpayer Relief Initiative Work.

For filing help call 800-829-1040 or 800-829-4059 for TTYTDD. 2 The Statute of Limitations for Unfiled Taxes. After the IRS determines that additional taxes are.

3 or 4 days after e-filing a tax year 2020 or 2019 return. First the legal answer is in the tax law. 21 Figuring out Your Collection Statute Expiration.

As stated before the IRS can legally collect for up. Most of the time people can set up these payment plans on irsgov. However there are statutes of limitations in place that limit the amount of time the state and federal government have to collect your back taxes.

That statute runs from the date of the assessment. How far back can the IRS collect unpaid taxes. In addition the IRS will apply future.

For taxpayers who filed their state returns by Sept. How Long Does The IRS Have To Collect Back Taxes. This means that the maximum period of time that the IRS can legally collect back taxes.

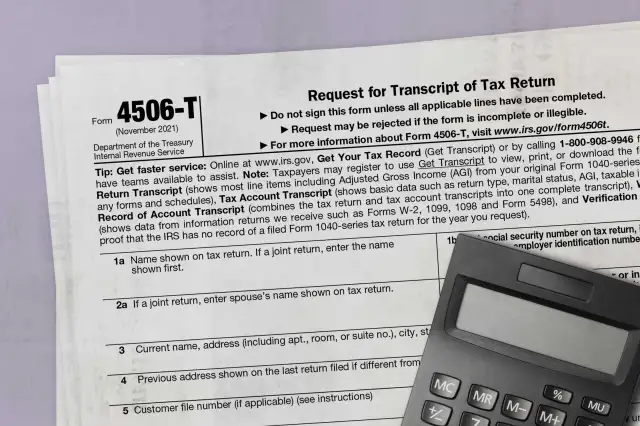

If you need wage and income information to help prepare a past due return complete Form 4506-T Request for. The IRS will provide up to 120 days to taxpayers to pay their full tax balance. 1 Four Things You Need to Know If You Have Unfiled Tax Returns.

Some years the IRS changes the tax filing deadline. This is known as the statute of. For most cases the IRS has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due.

NEW YORK AP President Joe Bidens student loan forgiveness program announced in August will cancel up to 20000 in debt per. The IRS may also levy assets such as your wages bank accounts Social Security benefits and retirement income.

Updated 2020 Do You Owe Back Taxes Here S What To Do

Federal Guidelines For Garnishment Turbotax Tax Tips Videos

Where S My Refund Tax Refund Tracking Guide From Turbotax

12 Reasons Why Your Tax Refund Is Late Or Missing

Where Is My Tax Refund 2021 How Long Does Irs Take To Process Taxes

Why Your Irs Refund Is Late This Year Forbes Advisor

How Long Does The Irs Have To Collect Back Taxes Understanding C S E D Dates Do You Owe Back Taxes To The Irs Or State You Know You Owe Back Taxes To The

Can The Irs Collect After 10 Years Fortress Tax Relief

How Long Does It Take The Irs To Issue An Amended Tax Return Refund Debt Com

How Much Do You Get Back In Taxes For A Child In 2021 As Usa

Tax Refund Schedule 2022 How Long It Takes To Get Your Tax Refund Bankrate

Where S My Tax Refund Irs Holds 29m Returns For Manual Processing

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

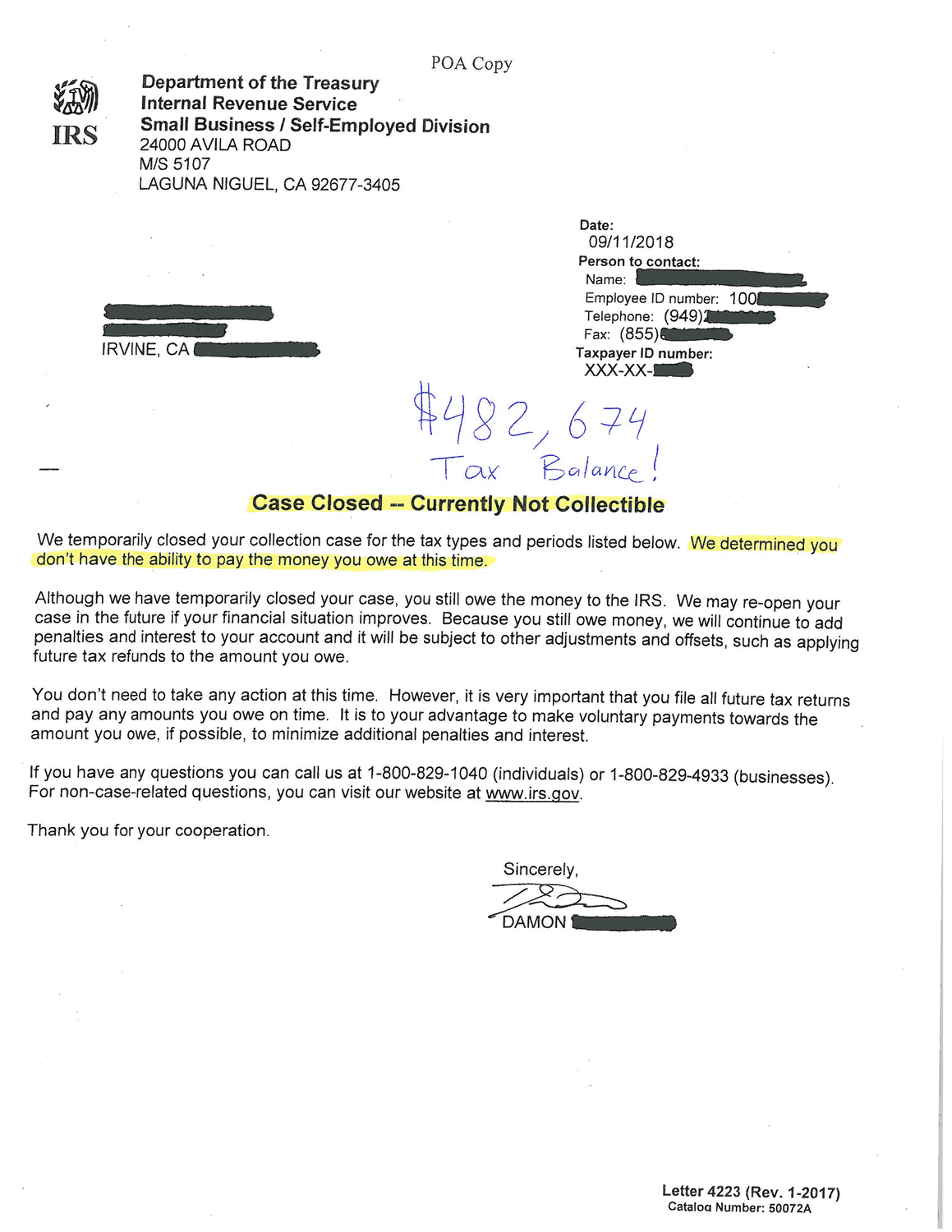

How 482 674 In Irs Back Taxes Required Zero Payments Landmark Tax Group

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

How Long Does It Take To Get A Tax Refund Smartasset

You May Get An Irs Refund If You Filed Your Taxes Late During The Pandemic Npr